Zakat Calculator With Debt

Login Login Banking securely Register for new mobile banking app. Banking you can believe in.

Meanings of Zakah 2.

Zakat calculator with debt. The basic principle is that debts are deducted from wealth and if the remainder is still above the nisab threshold zakat is payable otherwise not. However ideally this deduction should only be made if paying Zakat will impact your ability to repay the debt. Zakah on Debts 7.

For the cause of Allah Including education Dawah work programs and any effort to strengthen. Zakat Foundation of America has provided an online Zakat Calculator to help Muslims easily and accurately calculate and pay their Zakat go to Zakat Calculator. Tohose in bondage or in debt.

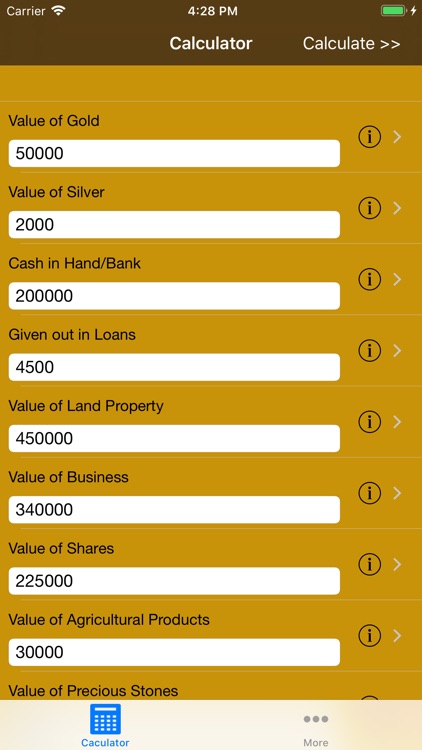

Given out in loans. Zakah on Gold and Silver 11. As of Monday 12 April 2021 The Price of Gold per gram is AUD7354.

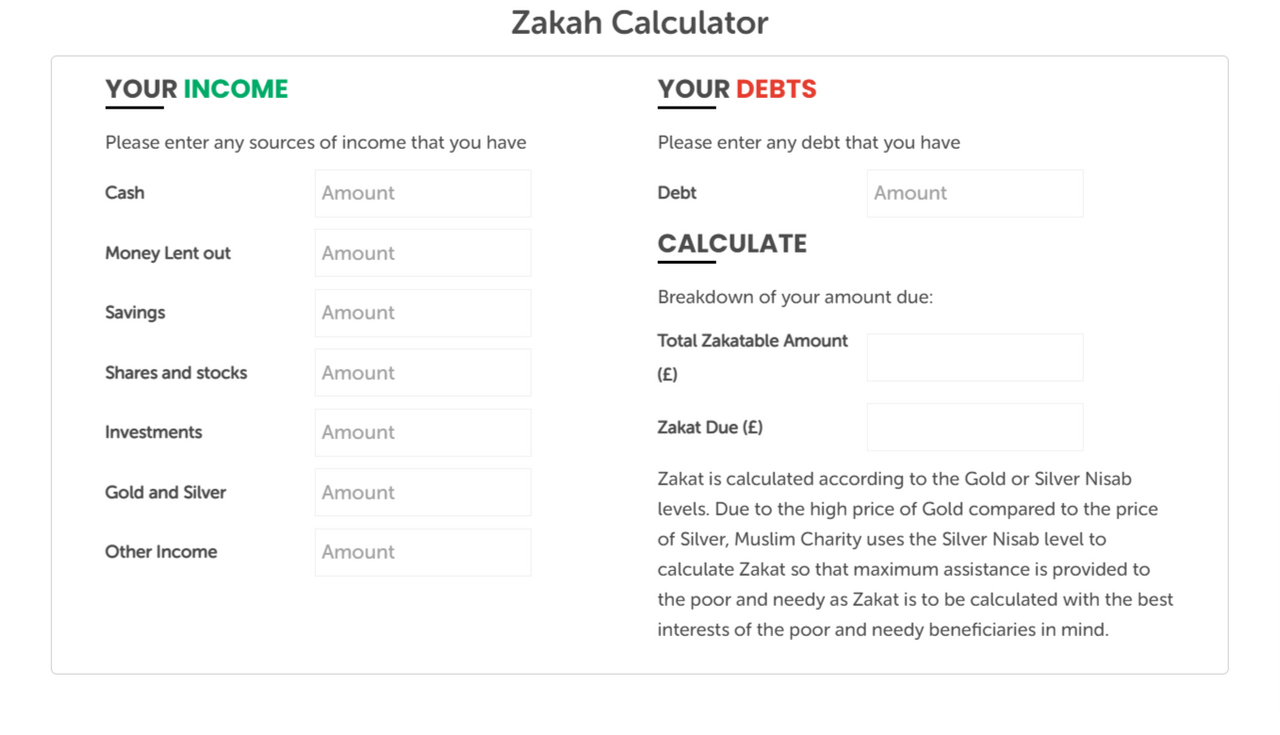

Debts owed to you Liabilities. If you use the accumulated money to pay off the debt before zakaat is due you only pay zakat on what you have left so if what you have left is less than nisab you dont pay zakat. Loans Debts.

However if a person has a large debt that is being paid off in instalments such as a mortgage or large credit card debt then one should only deduct the payment that is currently due from one. With regards to debt deductions there is permissibility cited by scholars to deduct one years worth of repayments. The basic principle is that debts are deducted from wealth and if the remainder is still above the nisab threshold zakat is payable otherwise not.

Nisab which is equal to 3 ounces of gold is the minimum amount of wealth one must have before they are liable to pay zakat. In hand and in bank accounts. Am I still liable to pay Zakat if my wealth went below the nisab in between the lunar year.

Understanding Calculation 3 Content 1. However if there is any doubt about when and if you will recover the debt do not include it here -- but include it in the year you actually receive it and pay zakat for all previous years that the debt was outstanding. Zakah on trading.

Sum personal wealth business wealth x 025 necessary due debt advanced zakat payment due zakat. People who collect Zakt. Some Important rules relating to recipients of Zakah 9.

Business investments shares saving certificates pensions funded by money in ones possession. However if a person has a large debt that is being paid off in instalments such as a mortgage or large credit card debt then one should only deduct the payment that is currently due from ones. The amount you paying in a oneach full year will not be included in Zakat rest you have to pay.

Our new mobile banking app is ready to download now. Zakat calculator Who To Give Zakat To As-Sadaqat Zakat are only for the poor and for the needy and for those employed to collect zakay and for bringing hearts together for Islam and for freeing captives or slaves and for those in debt and for the cause of Allah and for the stranded traveler an obligation imposed by Allah. Deposited for some future purpose eg.

Zakat on debts can be deferred till repayment for all years they were owed or paid annually. For example total debt amout 50000 but only paying let say 5000. Retribution for not giving Zakah 4.

Zakat on wealth paid from that wealth is a central concept and explains why scholars prohibit deducting student debt in ones Zakat calculation in general. IslamicFinder Online Zakat Calculator 2021 provides you a step by step method to calculate Zakat on your assets. Here is the overall formula for Zakat calculation.

Enter the Value of Nisab in your local currency. The 5000 will be consider debt in zakat calculation. Recipient of Zakah 8.

Payer of Zakah 5. So if you have had that 400 for 1 complete lunar year you pay 10 for zakat. Zakat is due on debts you are sure will be repaid to you such as loans to friends and family.

Calculate your Zakat contribution with our Zakat calculator and conveniently pay for your Zakat online. Zakat is payable at 25 of the wealth one possesses above the nisab. Nisab updated 09 April 2020.

Zakah on Cash 12. Zakat is to be paid on Silver in Pure form or Silver Jewellery at 25. People whose hearts are to be reconciled.

If you are uncertain when your wealth exceeded the nisab then use an approximate date. Outstanding wages unpaid dowry inheritance and trusts other than bare trusts are exempt from zakat. NIsab value is updated monthly.

So if your worth is 100000 then you owe Zakat on 76000 which would come out to 190000. According to Sharia Law Nisab is the minimum amount a person possesses for over a year in order to be obliged to pay ZakahYou can calculate nisab in terms of either Gold or Silver value. Zakat on Pure Gold and Gold Jewellery.

Every year on that lunar date you must re-calculate your Zakat. Zakat should be calculated at 25 of the market value as on the date of valuation In our case we consider 1st of Ramadan. Needy people in financial hardship and debt with very limited income such as the Students of knowledge.

1 debts to God like owed Zakat expiations for missed worship and penalties for violations. If you are owed any debts and you believe the debt can be recovered on demand add it here. If you have a total of 400 now but only 300 of that has been in your possession for a.

In brief debts are of two types. Benefits of Zakah 3. And 2 debts to people which can include Zakat as well.

If the Zakat payment does not impact your ability to repay your debt we encourage that the deduction is not made. If your wealth exceeds the nisab at the start and. Zakat calculator with Al Rayan Bank formerly Islamic Bank of Britain IBB.

As of January 18 2021 nisab is estimated to be 553395 Zakat is liable on gold silver cash savings investments rent income.

Zakat Calculator Nisab Based Ramadan 2022 Calculator Bay

Zakat Calculator Stocks Balance Sheet

Pin On Everything Ayeina Com Ayeina Board

Ultimate Tax Relief Guide For Malaysians Infographic Tax Guide Tax Debt Relief Filing Taxes

Online Zakat Calculator 2021 Ramadan 2021

Zakat Leading To Helper S High Islam Pop Art Wallpaper Rings For Men

Pin By The Grateful Servant On All About Sadaqa Dua For Ramadan Tahajjud Namaz Life Path

Zakat Meaning Importance Payers Recipients Zakat Meaning Importance

Zakat Calculator Plus By Ifahja Consulting Private Limited

Zakat Calculator By Muslimcharity On Deviantart

Zakat Calculator Online Zakat Calculator My Qiblah

Zakat Calculate Zakat Calculator Nisab 2020 Zakyat Charity Foundation

Islamic Banking Or Islamic Finance Or Sharia Compliant Finance Is Banking Or Financing Activity That Complies With Sharia Islami Islamic Bank Islam Investing

Post a Comment for "Zakat Calculator With Debt"