Gratuity Calculator For 10 Years Of Service

Here n The service tenure completed by an individual in a company. Groww uses a proprietary formula that is benchmarked with other similar offerings.

Gratuity Calculator When And How Much Gratuity Will I Get Abc Of Money

23rd of his ESB award.

Gratuity calculator for 10 years of service. Is there any Slab system in Gratuity Calculation. The 7th pay commission recommended to enhance the ceiling of Gratuity from Rs. 23 of the figure 3-5 years to get the total gratuity pay.

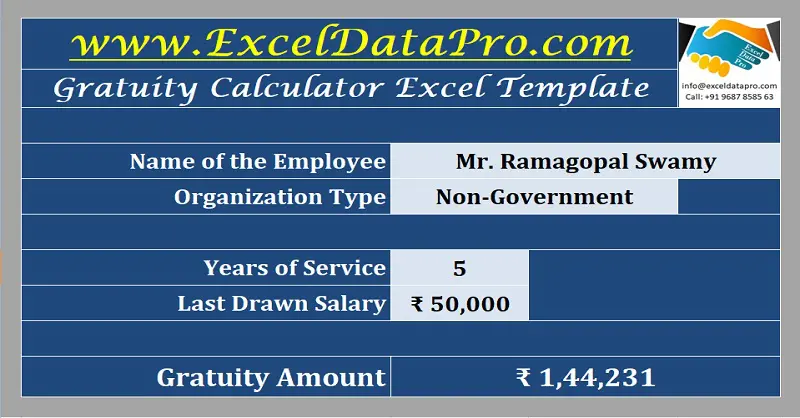

If an employee has served more than 5 years he is entitled to. Here The last drawn salary includes basic and dearness allowance DA. Gratuity Last drawn salary x 1530 x Number of years of service In the above example if your organization is not covered under the Act then the calculation will be as follows Gratuity Rs 80000 x 1530 x 10 Rs 400 lakhs.

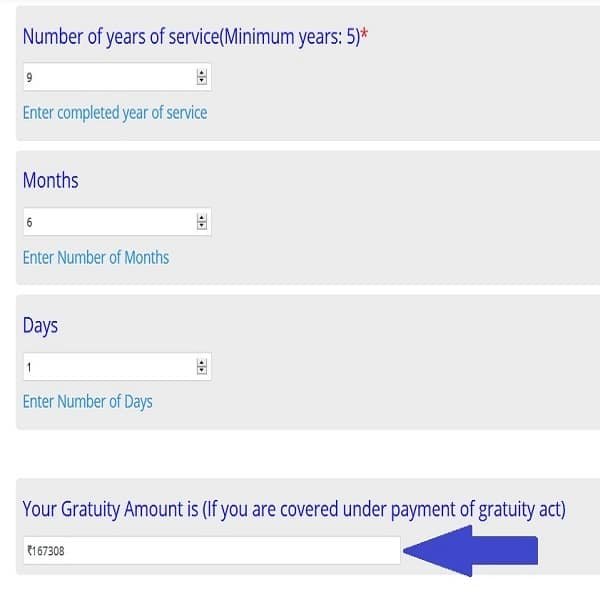

Our online gratuity calculator will help you in that aspect too. The information and details contained herein are based on the minimum terms and conditions prescribed in the UAE Labour Law and any outcome resulting from the use of the Gratuity Calculator should not be construed as final and binding. You can also calculate the end of service gratuity on the Ministry website by entering joining date last working date basic monthly salary and number of gratuity days due for each year.

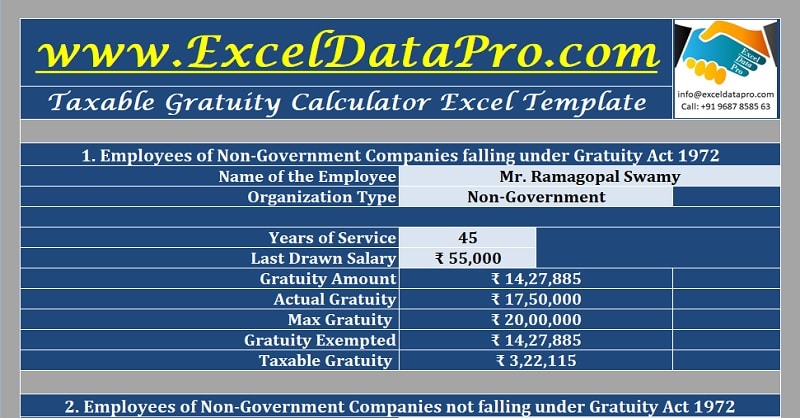

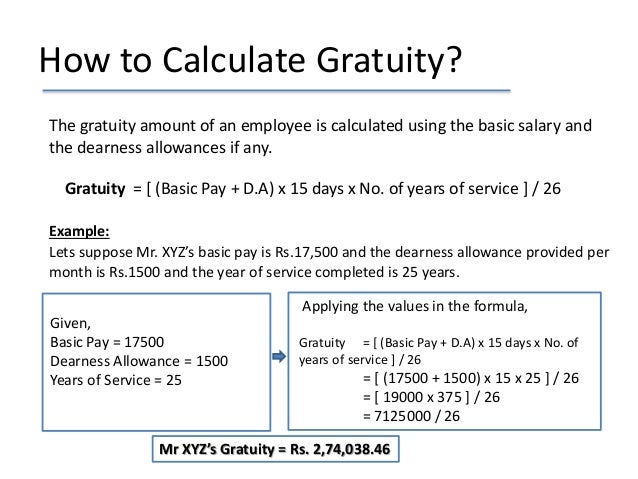

For calculation of gratuity of employees in such organisations the formula is Gratuity 15 x last drawn salary x number of completed years of service 26. Calculation of Gratuity Basic Pay Dearness Allowance x 15 days x Number of Years of Service 26 Days. For the purpose of gratuity calculation the last drawn salary of MrX is the sum of the basic salary and the dearness allowance Rs15000 Rs3000 Rs18000.

The calculation for this is. If an employee resigns before completing 1 year of service he is not entitled to any gratuity pay. Weekly holiday should be given to employees is compulsory.

The maximum amount of Death Gratuity admissible is Rs. Get the 13 of this figure 1-3 years. In this case what employee has to do.

10 lakh to 20 lakh. Completed years of service include any year where an employee has served for more than 6 months. Why calculating taken 26 Days instead of 31.

A retiring Government servant will be entitled to receive service gratuity and not pension if the total qualifying service is less than 10 yearsThe admissible amount is half a months basic pay last drawn plus DA for each completed 6 monthly periods of qualifying service. As per Article 85 of Saudi Labor Law an employee who resigns after completing 5 years but before 10 years of service is entitled to. So if you have a service of 12 years and 10 months you get gratuity for 12 years and not 13 years.

If A is number of years of service in a company B is last drawn salary Basic Salary Dearness Allowance Then Gratuity AB1526. Gratuity Calculation Basic Pay DA x 15 days x No. Employer is not given any notice.

The formula used by our online gratuity calculator is. In this case the service years are not rounded off to the next number. Multiply it by 21 AED 33330 x 21 699930.

Termination after more than 5 years of service gratuity calculation to be done as 30 days basic salary for each year of service after first 5 years and 21 days basic salary for the first five years. One can calculate hisher gratuity amount with the help of the following formula. If an employee has served between 3 and 5 years he is entitled to two-thirds 23 of 21 days basic salary as gratuity pay.

Any person employed on wagessalary. Calculating Gratuity For Limited Contract. There are three types of Gratuity in force in Government services.

As per the labour law in India the maximum working days in a month should be 26. For example Ankit has worked for QC Associates for 10 years and his last drawn salary Basic Dearness Allowance is Rs 30000. If employer ask for resignation and employee not given.

Number of years of service 5 years and 9 months 6 years rounded Hence Total Gratuity Salary 26 15 Number of years of service. DDA has prepared an electronic form of Gratuity Calculator for sample calculation basis to Licensees and their employees in respect to their employment matters. Gratuity Average salary basic DA Number of service years.

So is the gratuity calculation formula is a simple formula so it is 15 by 26 multiplied by the total amount of your basic DA and commission multiplied by a total number of years of service plus an excess of six months to be considered as a completed year for example. Gratuity Calculation FormulaNumber of completed years of service nbasic salary last drawn plus dearness allowance b1526. Although the service is available only in Arabic non-Arabic speakers can also easily calculate ESB by following these steps.

Any other component of income will not be included in the salary. And after some days employer oral tell dont come to office. If an employee has served between 1 and 3 years he is entitled to one third 13 of 21 days basic salary as gratuity pay.

At the time of retirement or resignation or on superannuation an employee should have rendered continuous service of not less than five years. Resignation between 5 to 10 years. 12 salary for 5 years Full salary for each next year.

An employee resigned after working for 7 years in a company. Of years of service 26 Where DA Dearness Allowance. What is the ceiling of Gratuity.

Total gratuity should not exceed two-year basic salary. If yes please explain with example for 5 year service 10 years and above 15 years and above. End of Service Benefits Eligibility.

If you are eligible for payment of gratuity you must first check how much you are eligible for. For those who have worked 5 years or more the full AED 699930 is payable for each year if you have completed 5 years or more. 15 being wages for 15 days and 26 being the days of the month.

So 21-days salary is AED 699930.

Download Gratuity Calculator India Excel Template Msofficegeek

Download Gratuity Calculator India Excel Template Msofficegeek

1 Gratuity Calculator Check Everything Free

Download Taxable Gratuity Calculator Excel Template Exceldatapro

Calculation Of End Of Service Gratuity In Uae Labour Lawyers In Dubai Understanding Medical Insurance Labor Law

Download Gratuity Calculator India Excel Template Exceldatapro

Online Or Excel Gratuity Calculator 2021 Formula Purpose In India

What Is Gratuity In Salary How Is Gratuity Calculated Its Eligibility Abc Of Money

1 Gratuity Calculator Check Everything Free

End Of Service Gratuity Computation As Per Uae Labor Law Labor Law Resignation Service

Understanding Gratuity Calculations Labour Lawyers In Dubai Understanding Medical Insurance Legal Advice

Gratuity Calculation In India 2021 Eligibility Criteria Categorisation Of Employees And Formula For Gratuity Calculation Financialcalculators In

Download Gratuity Calculator India Excel Template Msofficegeek

Gratuity Formula Rules Limit Eligibility Calculation Formula Evaluation Employee Rules

Download Gratuity Calculator India Excel Template Msofficegeek

Download Gratuity Calculator India Excel Template Msofficegeek

Post a Comment for "Gratuity Calculator For 10 Years Of Service"