Calculate My Annual Net Income

The annual net income is calculated by subtracting the amounts related to the tax Canada Tax and Ontario Tax the Ontario surtax the Canadian Pension Plan the Employment Insurance. Determine your annual salary.

Net Income After Tax Niat Overview How To Calculate Analysis

Set the net hourly rate in the net salary section.

Calculate my annual net income. Also known as Gross Income. Simply enter your annual or monthly income into the salary calculator above to find out how taxes in Ireland affect your income. The formula for calculating net income is.

If you are considered a salaried employee then your annual salary may already be. The following calculator can be used to calculate your hourly to salary rate. Gather your total.

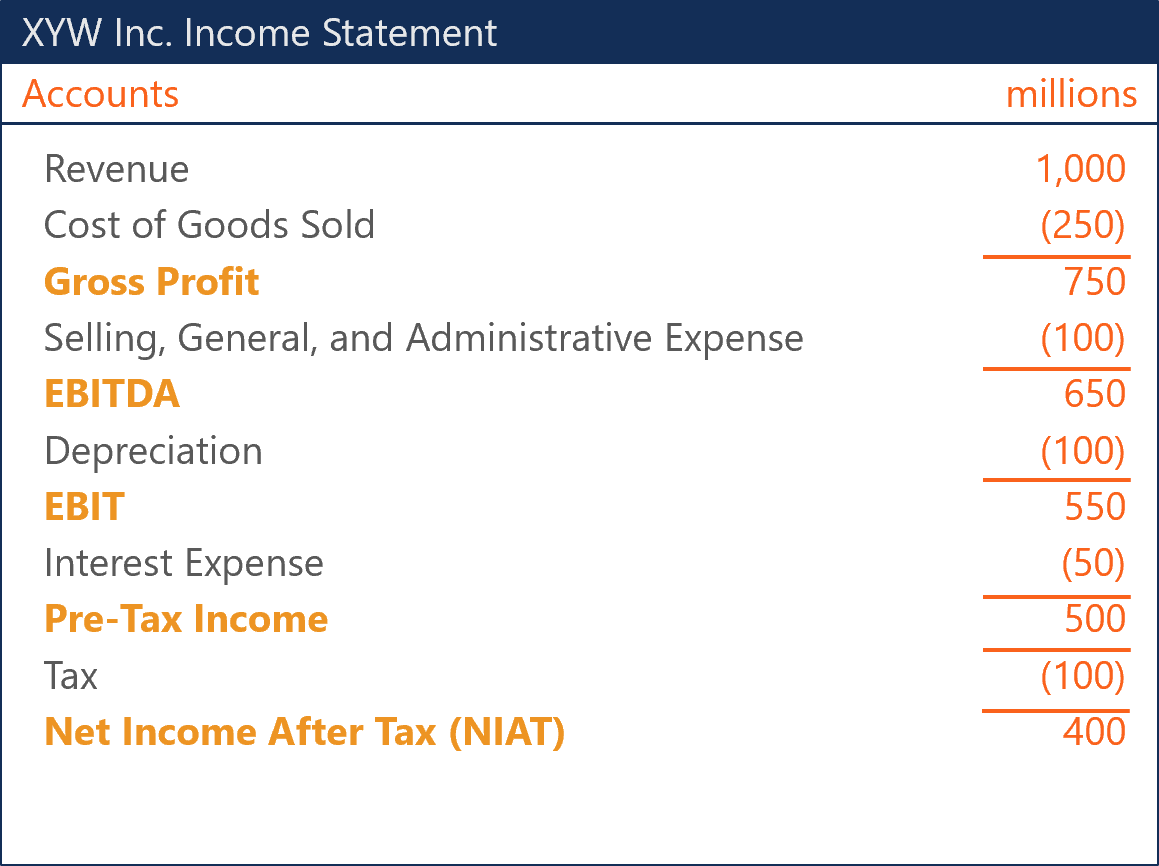

Revenue Cost of Goods Sold Expenses Net Income The first part of the formula revenue minus cost of goods sold is also the formula for gross income. Why not find your dream salary too. We put together a simple guide for all you need to know about cost of goods sold.

Annual Salary PDHWBO. Hourly rates weekly pay and bonuses are also catered for. Gross annual income - Taxes - Surtax - CPP - EI Net annual salary Net annual salary.

The Salary Calculator tells you monthly take-home or annual earnings considering UK Tax National Insurance and Student Loan. 30 8 260 - 25 56400 Using 10 holidays and 15 paid vacation days a year subtract these non-working days from the total number of working days a year. 32000 21000 53000 Total gross annual income If Sarah is eligible for deductions of 5000 for education andor childcare expenses she may be able to lower her taxable income in some jurisdictions.

All bi-weekly semi-monthly monthly and quarterly figures. W is the number of weeks worked per year. D is the number of days worked per week.

Once you determine your annual salary you can now add that. To determine your NET MONTHLY INCOME divide your NET ANNUAL INCOME by 12. An Estimate of Net Annual Income Wage earners receive earnings statements from their employers.

Use this amount on your budget form. Where P is your hourly pay rate. To calculate net annual income subtract annual taxes paid from gross annual income.

How to calculate annual income. KiwiSaver Student Loan Secondary Tax Tax Code ACC PAYE. This calculator is always up to date and conforms to official Australian Tax Office rates and formulas.

Therefore multiply 1235 by 24 semi-monthly 29640 net annual income. 53000 5000 48000 Net taxable income. Calculate your take home pay from hourly wage or salary.

Add your additional income to your gross annual salary. Thomas is paid on the 1st and the 15th of every month. If youre in a new job you can check your pay stubs to look for your net income per pay period then use that figure to determine your annual salary.

The formula for calculating bet income is. To use the tax calculator enter your annual salary or the one you would like in the salary box above If you are earning a bonus payment one month enter the value of the bonus into the bonus box for a side-by-side comparison of a normal month and a bonus month. Therefore net annual income is net income for a calendar year or any other 12-month period.

H is the number of hours worked per day. Use this calculator to quickly estimate how much tax you will need to pay on your income. Where BO is bonuses or overtime.

Therefore he is paid semi -monthly. New Zealands Best PAYE Calculator. 4Example Calculations of Net Monthly Income Case 1.

If this is the case her net taxable income would be as follows. Budget 2021-22 update This calculator has been updated with tax changes set out in the 2021-22 Budget. His take home net is 1235.

Or Enter either your gross hourly wage into the first field or your gross annual income into the fourth field. The adjusted annual salary can be calculated as. The latest budget information from April 2021 is used to show you exactly what you need to know.

Revenue - cost of goods sold - expenses net income Income statements include net income as a profitability indicator and can be used by businesses to determine their earnings per share. Youll then get a breakdown of your total tax liability and take-home pay. There are two ways to determine your yearly net income.

How to calculate annual net income 1. Salary Before Tax your total earnings before any taxes have been deducted. Annual Income Formula.

Since it appears at the bottom of an income statement analysts refer to it as the bottom line. Annual income is defined as the annual salary before taxes an individual earns on a yearly basis. Use our employees tax calculator to work out how much PAYE and UIF tax you will pay SARS this year along with your taxable income and tax rates.

How To Calculate Net Income Formula And Examples Bench Accounting

How To Find Net Income Calculations For Business

How To Calculate Net Income 12 Steps With Pictures Wikihow

How To Calculate Pre Tax Profit With Net Income And Tax Rate The Motley Fool

How To Calculate Net Income 12 Steps With Pictures Wikihow

Taxable Income Formula Examples How To Calculate Taxable Income

How To Calculate Net Income 12 Steps With Pictures Wikihow

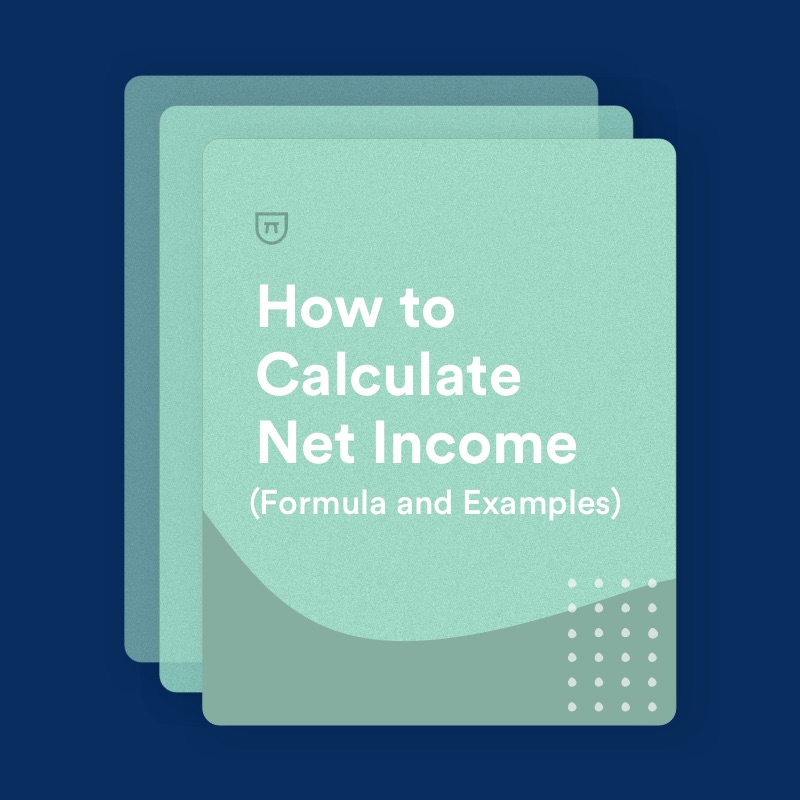

Gross Income Vs Net Income Creditrepair Com

Gross Income Vs Net Income Creditrepair Com

What Is Gross Vs Net Income Difference And How To Calculate Mbo Partners

Based On The Information Provided How Would You Calculate The Annual Net Income G Brainly Com

How To Calculate Net Income 12 Steps With Pictures Wikihow

How To Calculate Net Income Howstuffworks

How To Calculate Net Income 12 Steps With Pictures Wikihow

Gross Income Formula Step By Step Calculations

4 Ways To Calculate Annual Salary Wikihow

What Is Gross Income Business Gross Income Individual Gross Income Mageplaza

:max_bytes(150000):strip_icc()/AppleIncomeSattementDec2019-cd967d0a8f5e4748a1060f83a7e7acbc.jpg)

Post a Comment for "Calculate My Annual Net Income"