Zakat Calculator Student Loans

This is the amount Zakat is due upon. Please provide me with your in-depth analysis on it.

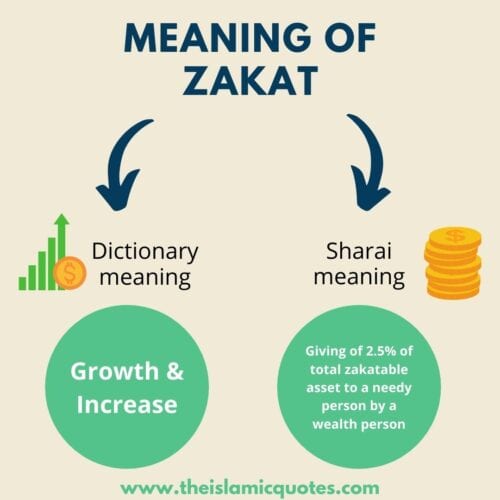

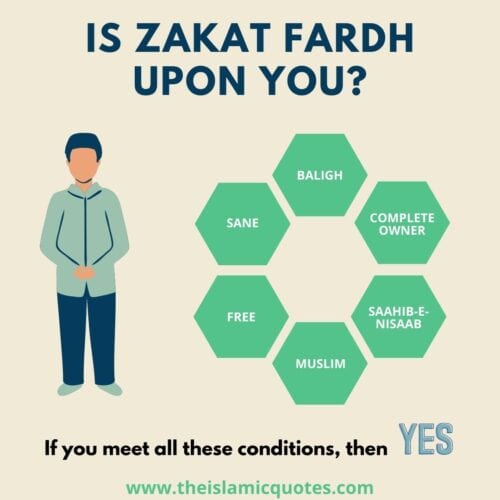

Zakat In Islam Its Importance Eligibility Calculation

A loan you have taken out to acquire non-zakatable assets such as furniture machinery and buildings are not deductible.

Zakat calculator student loans. I have gold of approx. Calculate and pay Zakat with Muslim Charity to help those in need. In the name of Allah the most Beneficent the most Merciful.

If you are repaying your loan only 12 months worth is deductible. Zakat on student loans. Wait for the return of the loan three years later and pay zakat for each of the three years that it was loaned out.

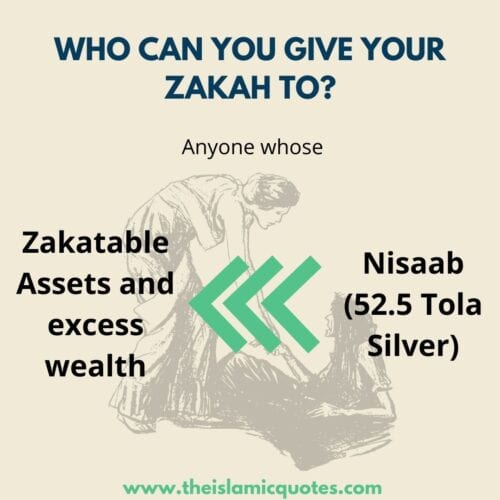

I have a student loan approx. Which would mean that they pay 2125 of Zakat 25 of 85000. A loan you have taken out to acquire zakatable assets such as raw materials goods and so on can be deducted from your capital.

If youre not currently repaying your loan it shouldnt be taken off your Zakat. If you have more questions contact our zakat specialists. If you have taken out a student loan to cover the cost of your tuition fees or living costs throughout the duration of your study its important to make sure that you factor this into your Zakat calculation correctly.

On the other hand lets they were to pay 98000 off their loan off that year leaving them with a loan. I do not have any balance in my bank at the end of month. As you are not earning 1500000 at the moment you are not liable to make any payment to the student Loan Company.

And Allah knows best. Sum personal wealth business wealth x 025 necessary due debt advanced zakat payment Due Zakat. Would this count as a liability.

26000 and Credit Card loan 9000. The debtor would have to pay Zakat on their 85000 savings minus installments in their bank account despite having a negative net worth. Anzeige Use the Zakat calculator to easily calculate how much Zakat is due from you.

Why do student loans not count as debt in zakat calculation. Where to calculate your zakat. I have a student loan.

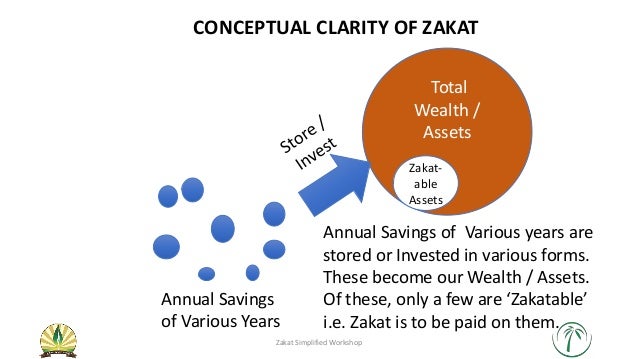

A Student Loan will not be added to ones zakh liability section as a whole in every zakat year. Anzeige Use the Zakat calculator to easily calculate how much Zakat is due from you. Zakat calculator Enter all assets that have been in your possession over a lunar year in the text boxes below.

Calculate and pay Zakat with Muslim Charity to help those in need. I paid it out of fear of Allah swt but I really dont understand how we are going to be able to pay this every year. Can I include student loans in the zakat calculations as a debt.

Pay zakat on the 1000 each year until she receives the loan back. Here is a simple and easy way to calculate your zakat using our comprehensive zakat calculator. Thus what is taken into consideration is the amount one possesses above the zakatable-minimum at the end of ones Zakat year.

Join READ Foundation and Imam Abid on this series in discovering more about zakat and answering your QAs. Here is the overall formula for Zakat calculation. There are two possible situations of whether you will deduct the amount of the student loan or not in calculating the zakat.

1 debts to god like owed. To explain further the rationale explained by the fuqah for the deduction of debt from ones zaktable assets is that to settle ones debt and so protect oneself from punitive measures is a basic necessity and whilst such assets are engaged by ones basic necessity one cannot be said to possess. Find out if there is Zakat on student loans you have taken out and if you need to pay Zakat when you are a student.

In brief debts are of two types. Search in titles only Search in Religion Philosophy only. What should be my Zakah under the following situation.

One pays zakat out of his or her eligible kind of wealth. Zakat Foundation of America has provided an online Zakat Calculator to help Muslims easily and accurately calculate and pay their Zakat go to Zakat Calculator. Under the current student loans system in the UK loans are recovered through a repayment system based on income and amount borrowed.

Regarding your query on zakh if you have a surplus amount of wealth that is equal or exceeds the nisb of silver which happens to be 61236 grams you will be obligated to pay zakh provided your debt is not greater than your surplus and youve possessed the funds for a complete lunar year. As a result we are have to start saving emergency funds all over again. If then for example one possesses 2500 on the 1nd of Rabi al-Awwal of the next year one will have to pay 25 of 2500.

You pay zakat on what remains. Zakat on wealth paid from that wealth is a central concept and explains why scholars prohibit deducting student debt in ones zakat calculation in general. If you are not currently repaying your loan it is not deductible.

700 gram with my wife.

Zakat In Islam Its Importance Eligibility Calculation

Zakat Calculate Zakat Calculator Nisab 2020 Zakyat Charity Foundation

Zakat Calculator Zaytuna College

9 Zakat Calculation Module Download Scientific Diagram

Your Zakat Guide Islamic Relief Canada By Islamic Relief Canada Issuu

Items Reported On A Balanced Sheet Of An Islamic Bank Company And Its Download Table

Can Student Loans Be Deducted From Zakat As Debt Zakat Foundation Of America

The Ultimate Guide To Zakat Proven

Sahabat Sopan Hidayat Yuk Cari Tau Dulu Yuk Apasih Bedanya Zakat Infaq Sedekah Dan Wakaf Itu Sendiri 1 Zakat Adalah Sejumlah Blog Membaca Qur An

Read Zakat Calculation Online By Yusuf Al Qaradawi And Mushfiqur Rahman Books

Zakat In Islam Its Importance Eligibility Calculation

When Do We Pay Zakat About Islam Financial Tips Home Buying Process Interest Rates

Post a Comment for "Zakat Calculator Student Loans"