Yearly Income Tax Calculator Canada

The basic personal tax amount CPPQPP QPIP and EI premiums and the Canada employment amount. The tool then asks you to enter the employees province of residence and pay frequency weekly biweekly monthly etc.

Income Tax Rates For The Self Employed 2020 2021 Turbotax Canada Tips

The reliability of the calculations produced depends on the accuracy of the information you provide.

Yearly income tax calculator canada. Fuel Tax 150. The calculator will show your tax savings when you vary your RRSP contribution amount. Tax rates for previous years 1985 to 2020 To find income tax rates from previous years see the Income Tax Package for that year.

In Canada these rates also vary from province to province which makes it a little more complicated to. The tax calculator is updated yearly once the federal government has released the years income tax rates. Total Estimated Tax Burden 19560.

This is any monetary amount you receive as salary wages commissions bonuses tips gratuities and honoraria payments given for professional services This amount is either 18 of your earned income in the previous year or the. Any income beyond the upper limit will be taxed at the next tax bracket rate of 26. The Canada Annual Tax Calculator is updated for the 202122 tax year.

June 28 2020. Canadian corporate tax rates for active business income. Use our simple 2020 income tax calculator for an idea of what your return will look like this year.

Find out your federal taxes provincial taxes and your 2020 income tax refund. Down below youll find three separate analyses that allow you to crunch the numbers from different perspectives. 7 rows Easy income tax calculator for an accurate British Columbia tax return estimate.

Province Select Province Alberta British Columbia Manitoba New Brunswick Newfoundland and Labrador Northwest Territories Nova Scotia Nunavut Ontario Prince Edward. Jan 01 2021 For example if you calculate that you have tax liability of 1000 based on your taxable income and your tax bracket and you are eligible for a tax credit of 200 that would reduce your liability to 800. In Canada there are federal and provincial income taxes paid while CPP is a contribution to the Canada Pension Plan and EI is a contribution to the Employment Insurance program.

The Union Budget 2020 has left individuals confused with the choice of the tax regime. Get started for free. At 80000 you will also have income in the lower two tax brackets.

Percent of income to taxes 35. Calculate the tax savings your RRSP contribution generates. 7 rows Canada income tax calculator.

These calculations are approximate and include the following non-refundable tax credits. Our income tax calculator calculates your federal state and local taxes based on several key inputs. Youll get a rough estimate of how much youll get back or what youll owe.

Rates are up to date as of June 22 2021. This calculator is updated yearly with the new yearly rates 2022 2023 etc As with many types of taxes the personal income tax in Canada is progressive which means higher income is taxed at a higher rate up to a maximum percentage. In Canada income tax is usually deducted from the gross monthly salary at source through a pay-as-you-earn PAYE system.

0 to 13229 and 13230 - 49020. 2021 - Includes all rate changes announced up to June 15 2021. For 2018 and previous tax years you can find the federal tax rates on Schedule 1For 2019 2020 and later tax years you can find the federal tax rates on the Income Tax and Benefit ReturnYou will find the provincial or territorial tax rates on Form 428 for the.

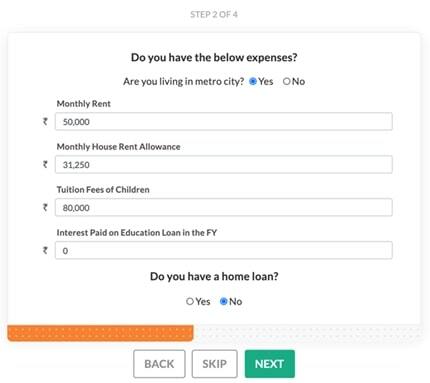

Both old and new tax regimes require a proper assessment before choosing one. Calculate Income Taxes for FY 2020-21. Calculate your combined federal and provincial tax bill in each province and territory.

Created with Highcharts 607. With the help of the income tax calculator you can gauge the impact of both the tax structures on your income. Finally the payroll calculator requires you to input your employees tax information including any entitled credits along with year-to-date Canada Pension Plan CPP and Employment Insurance EI contributions.

This page has been updated for the 2020 tax year This Canadian income tax calculator converts pre-tax income into after-tax dollars and provides comparisons across all provinces and territories in Canada. Your average tax rate is 220 and your marginal tax rate is 353This marginal tax rate means that your immediate additional income will be taxed at this rate. Online Income Tax Calculator.

Fidelitys tax calculator estimates your year-end tax balance based on your total income and total deductions. The average monthly net salary in Canada is around 2 997 CAD with a minimum income of 1 012 CAD per month. Your household income location filing status and number of personal exemptions.

Your income within those brackets 13229 and 35791 will be taxed at their respective tax rates of 0 and 15. The federal income tax deduction depends on the level of the annual income and it ranges between 15 and 33. You can calculate your Annual take home pay based of your Annual gross income and the tax allowances tax credits and tax brackets as defined in the 2021 Tax TablesUse the simple annual Canada tax calculator or switch to the advanced Canada annual tax calculator to review NIS payments and income tax.

If you make 52000 a year living in the region of Ontario Canada you will be taxed 11432That means that your net pay will be 40568 per year or 3381 per month. This places Canada on the 12th place in the International Labour Organisation statistics for 2012 after France but before Germany. After-tax income is your total income net of federal tax provincial tax and payroll tax.

In other words you would only owe 800 to the federal government. Free Income Tax Calculator - Estimate Your Taxes - SmartAsset. You assume the risks associated with using this calculator.

The Quebec provincial government administers its provincial income tax Quebec Pension Plan QPP and Quebec Parental Insurance Plan QPIP.

Canada S Federal Personal Income Tax Brackets And Tax Rates 2021 Turbotax Canada Tips

Tax Corporate Income Tax Rates Bdo Canada

Online Income Tax Calculator Calculate Income Taxes For Fy 2020 21 Scripbox

Income Tax Formula Excel University

Income Tax Formula Excel University

Marginal Tax Rates How To Calculate Ontario Income Tax Kalfa Law

Quebec Income Calculator 2020 2021

Taxtips Ca Ontario 2019 2020 Income Tax Rates

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Online Income Tax Calculator Calculate Income Taxes For Fy 2020 21 Scripbox

Online Income Tax Calculator Calculate Income Taxes For Fy 2020 21 Scripbox

Income Tax Formula Excel University

Income Tax Formula Excel University

Online Income Tax Calculator Calculate Income Taxes For Fy 2020 21 Scripbox

Personal Income Tax Brackets Ontario 2020 Md Tax

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Canada Federal And Provincial Income Tax Calculator Wowa Ca

How To Calculate Foreigner S Income Tax In China China Admissions

Post a Comment for "Yearly Income Tax Calculator Canada"