How To Work Out Annual Income Nz

Income Tax Calculator How to use the New Zealand Income Tax Calculator Just enter your gross annual salary into the box and click Calculate - then well show you a breakdown of how much PAYE tax youll pay and what your kiwisaver and student loan contributions will be. To use the calculator for the previous rates please click here.

Average Salary In New Zealand 2021 The Complete Guide

Simply enter your annual or monthly income into the tax calculator above to find out how taxes in New Zealand affect your income.

How to work out annual income nz. For gross profit margin you can set up an equation using line items in your income statement. Also known as Gross Income. For example if you are paid NZD 55000 an year for 40 to 45 hours of work a week the calculation is.

Take Home Pay Gross. Sixty per cent of four-person households earn more than 102500. Average salary in New Zealand is 82343 NZD per year.

Men receive an average salary of 95160 NZDWomen receive a salary of 71119 NZD. Stats NZ produces several measures of income. Of 50000 is paid the same amount every two weeks regardless of how many hours they worked each day in.

The statistics cover the working-age population of New Zealand. Calculate your take home pay. Use New Zealands best income tax calculator to work out how much money you will take home after taxes.

If you dont qualify for this tax credit you can turn this off under the IETC settings. 2020 median pay and pay ranges by job category. The most paid careers are Engineers Technicians III with average income 127600 NZD and Management Business with income.

You can vary the kiwisaver contribution rate to see the effect on your net pay. Annual Gross Pay Annual Take Home Pay Effective Tax Rate. It also changes your tax code.

Please note this calculator does not factor in ACC levies which are hugely variable. Take Home Pay Week. Salary Before Tax your total earnings before any taxes have been deducted.

Working for Families credits are available to households earning up to. The most typical earning is 51014 NZDAll data are based on 1463 salary surveys. There is no definitive income measure each is used for different purposes and has its own strengths and weaknesses.

Employers and employees can use this calculator to work out how much PAYE should be withheld from wages. To work it out. Opt Out 3 4 6 8 10.

55000 52 weeks 45 hours each week 2350 each hour. This calculator uses the new IRD rates post March 31st 2021 and does include the new 39 personal tax rate on remaining income over 180000. Simply enter your salary or hourly wage and let our calculator do the rest.

Find out how much money you actually have to work with. Youll then get a breakdown of your total tax liability and take-home pay. Pay As You Earn PAYE is a withholding income tax for employees in New Zealand.

For helpful advice regarding switching to a contract rate or employing people please contact us. For contribution margin make sure your income statement separates fixed costs and variable costs for the products services or locations you want to. Its useful for weekly fortnightly four weekly or monthly pays but it will not allow for.

Average weekly earnings are worked out by calculating the employees gross earnings over the 12 months prior to the end of the last payroll period before the annual holiday is. To use the PAYE calculator enter your annual salary or the one you would like in the Insert Income box below. Use this calculator to work out your basic yearly tax for any year from 2011 to 2021.

In most cases it is deducted from the. User guide for Stats NZs wage and income measures PDF 325 KB summarises these measures and how they are used. It will tell you how much money you will receive weekly fortnightly monthly and yearly in your payslip.

Extra pays like redundancy or special bonuses. The table below will automatically display your gross pay taxable amount PAYE tax ACC KiwiSaver and student loan repayments on annual monthly weekly and daily basis. Follow the instructions below to convert hourly to annual income and determine your salary on a yearly basis.

It will not include any tax credits you may be entitled to for example the independent earner tax credit IETC. Salaries are different between men and women. New Zealands median income is 52000.

Job categories with their median average pay and pay ranges for jobs advertised recently on Trade Me. Both are typically shown as a percentage. Simply enter your information and this form will turn hourly to salary.

Calculate Take Home Pay. If you are paid a salary and your hours change each week If you are paid a salary and your hours change each week we use the lowest hourly rate to calculate your level. Holiday pay that is paid as a lump sum.

It also will not include any tax youve already paid through your salary or. Please check ACCs website.

Median Hourly Wages In New Zealand Figure Nz

New Zealand Gross National Income 2020 Statista

Annual Personal Income For Adults In New Zealand Figure Nz

Income Distribution Of Individual Customers 2001 To 2019

Biochemist Average Salary In New Zealand 2021 The Complete Guide

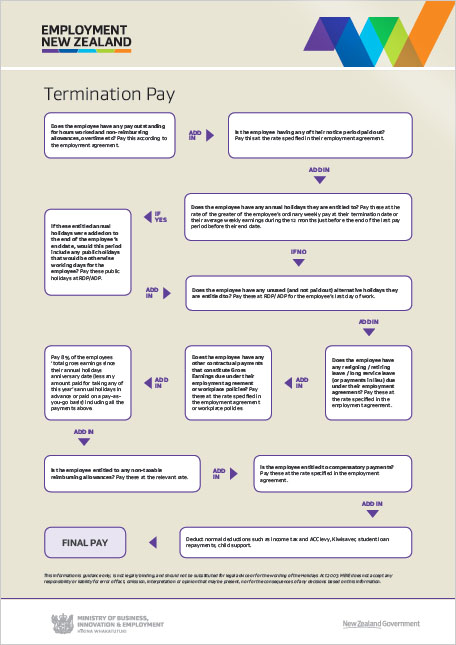

Final Pay Employment New Zealand

Median Household Income In New Zealand By Region Figure Nz

Average Hourly Wages In New Zealand Figure Nz

Wage And Salary Distributions For Individual Customers 2001 To 2020

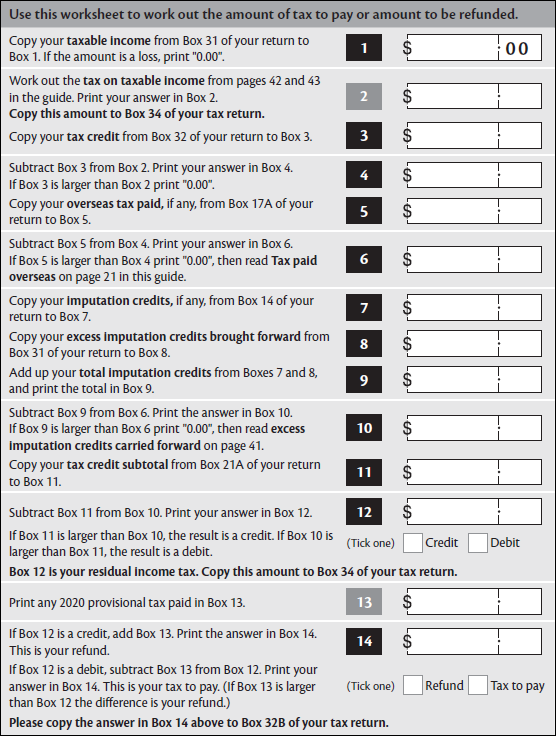

Ir3 Question 34 Tax Calculation Ps Help Tax Nz 2020 Myob Help Centre

Plumber Average Salary In New Zealand 2021 The Complete Guide

Personal Income Distribution Of Employed People In New Zealand Figure Nz

New Zealand Tax Codes And Rates Your Refund Nz

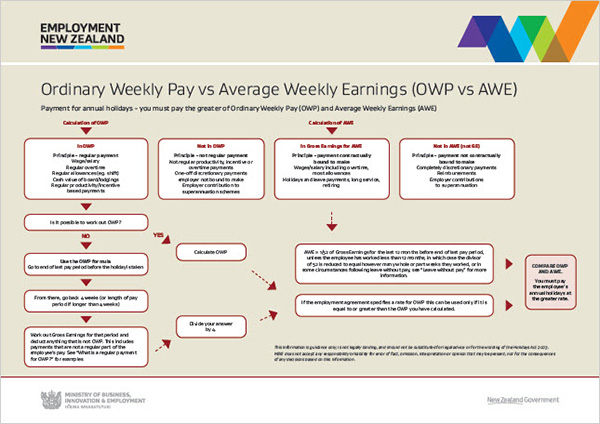

Calculating Annual Holiday Payment Rates Employment New Zealand

Relevant And Average Daily Pay Employment New Zealand

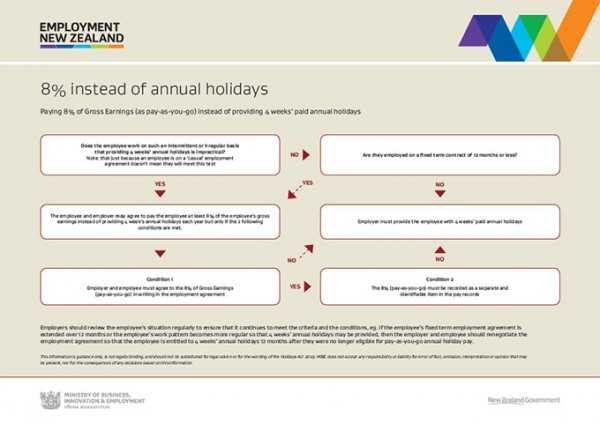

Pay As You Go For Fixed Term Or Changing Work Patterns Employment New Zealand

Data Analyst Average Salary In New Zealand 2021 The Complete Guide

Post a Comment for "How To Work Out Annual Income Nz"