How To Calculate Annual Taxable Income Philippines

Below is the calculation of how the taxable income from salary is calculated. Taxable Income of Apple Incs annual report for the year 2016 can be calculated as Taxable Earning Net sales Research and development expense Selling general and administrative expense Interest expense Non-operating income 215639 131376 10045 14194 1456 2804 Taxable Earnings 61372.

How Train Affects Tax Computation When Processing Payroll Philippines

Calculate your annual take home pay in 2019 thats your 2019 annual salary after tax with the Annual Philippines Salary Calculator.

How to calculate annual taxable income philippines. INCOME TAX DUE P130000 30 P200000 P190000. Minimum Corporate Income Tax on gross income. Chapter VI - Documentary Stamp Tax.

How to Compute Your Income Tax Using the New BIR Tax Rate Table. Chapter I - Income Taxes. Chapter IX - Tax Administration and Research.

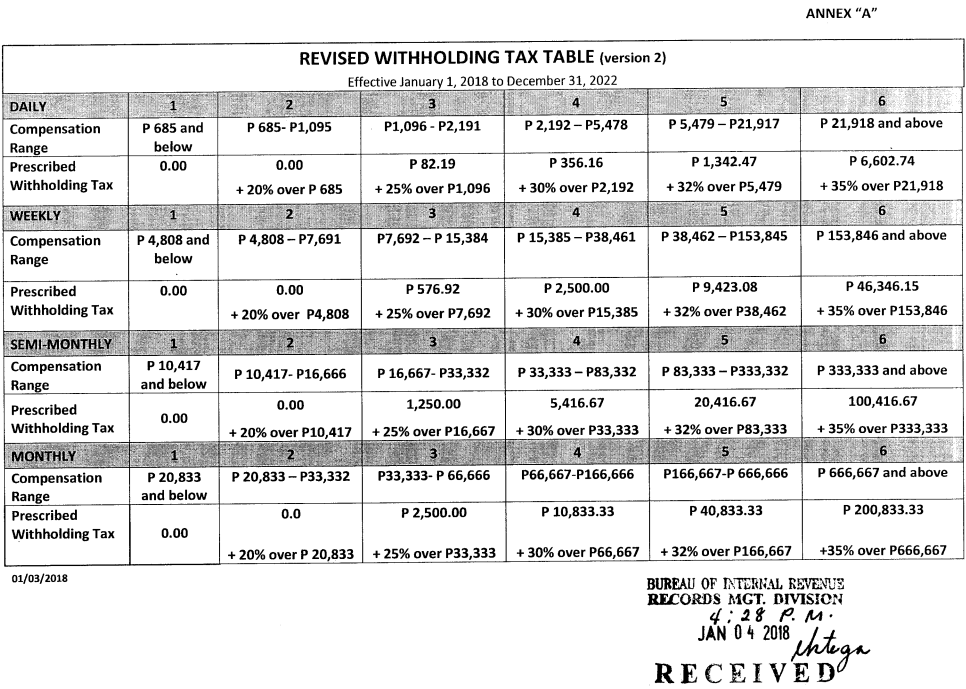

Base on our sample computation if you are earning 25000month your taxable income would be 23400. Your tax for the month is Php 195425 by simply checking on this BIR Tax Table. Gather your salary slips along with Form 16 for the current fiscal year and add every emolument such as basic salary HRA TA DA DA on TA and other reimbursements and allowances that are mentioned in your Form 16 Part B and salary slips.

On remainder of 352000 at 25. A quick and efficient way to compare annual salaries in Philippines in 2019 review income tax deductions for annual income in Philippines and estimate your 2019 tax returns for your Annual Salary in Philippines. This manual computation of your income tax uses the following formula to determine your income tax due.

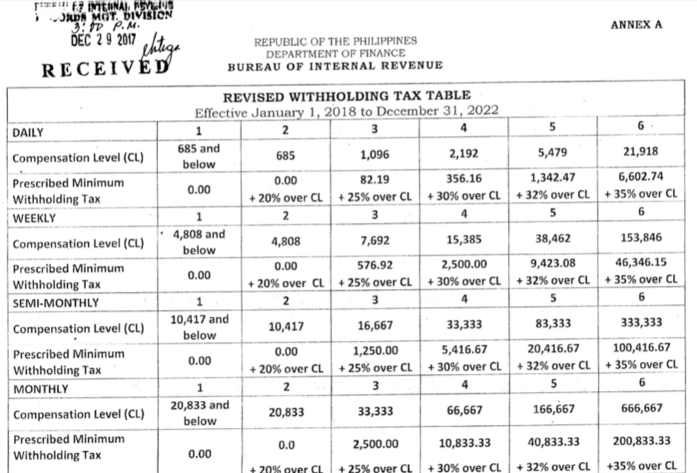

Taxable income is being computed as. Chapter V - Excise Taxes. Taxable income Monthly Basic Pay Overtime Pay Holiday Pay Night Differential Tardiness- Absences SSSPhilhealthPagIbig deductions Later well check how this table is being used in computing your income tax.

Gross Total Income is calculated as. On first 250000. Taxable income is the taxpayers gross income less allowable deductions.

International Carriers are taxed 25 on their Gross Philippine Billings. The Annual Philippines Tax Calculator is a diverse tool and we may refer to it as the annual wage calculator annual salary calculator or annual. Taxable income Gross income Allowable deductions x Tax rate Tax withheld.

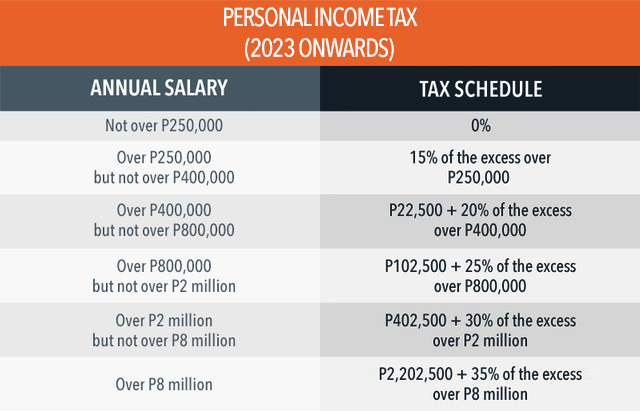

Compute for the Income Tax. With the new tax reform middle and low income earners will be exempted from income tax. Chapter VIII - Taxes Under Special Laws.

In General on taxable income derived from sources within the Philippines. If youre a self-employed or mixed-income taxpayer subtract the deductions allowed by the BIR from your gross income to get your taxable income. Chapter III - Value-Added Tax.

Tax withheld by employer per Form 2316 2 118000 0. Improperly Accumulated Earnings on improperly accumulated taxable income. Chapter II - Estate and Donors Taxes.

40000 - 35783 - 58130 - 43750 -100. During January after the end of the year the employer will make annual computations of compensation paid during the calendar year. Following is the procedure for the calculation of taxable income on salary.

2016 Guide to Philippine Taxes. Taxable income is your total annual income minus all the deductions and tax reliefs you are entitled for. Figures are computed based on actual and proposed first to third year income tax schedules.

Similarly we call for other values. Taxable income is calculated as. However the results may not necessarily coincide with tax payable up to the last peso and should not be used in filing for income taxes.

Chapter IV - Other Percentage Taxes. How to Compute Income Tax in the Philippines. Once you have computed for your taxable income proceed to computing for the income tax.

Tax computation in the Philippines changed this January 2018 in the form of the Tax Reform Bill of the Duterte Administration. You can see all the status in the legend on the bottom of the page. Gross Total Income 600000 10000 5600 120000 50000 8000.

Monthly Basic Pay Overtime Pay Holiday Pay Night. For all taxable partnerships the tax rate is also 32 of the Net taxable income from all sources. For Regional Operating Headquarters ROHQ the tax rate is 10 of Taxable Income.

Generally its the amount of income thats taxable unless exempted by law. Subtract your total deductions to your monthly salary the result will be your taxable income. Gross Total Income 693600.

The salaried employee earning P1 Million will thus pay income tax of P190000 under the new TRAIN tax tables. Chapter VII - Tariff and Customs Duties. Taxable Income 23000 58130 23000 00275 2 10000 23000 99755 Taxable Income 2200245.

The basic formula for income tax purposes is. The bonus received during the financial year must be added for the income. Taxable Income Monthly Salary - Total Deductions 25000 - 1600 23400.

Differential - Tardiness - Absences - SSSPhilhealthPagIbig deductions. Based on payroll details and tax status of employee it will make annual computations of income tax using the tax table for 5-32. Paying P190000 income tax on taxable income of P1 Million the taxpayer is therefore charged an effective income tax rate of 19.

Its used to compute how much income tax must be paid in a given year. 2 International Carriers on gross Philippine billings.

How To Compute Your Income Tax In The Philippines

2021 Philippine Income Tax Tables Under Train Pinoy Money Talk

How To Compute Quarterly Income Tax Return Philippines 1701q Business Tips Philippines

How To Compute Withholding Tax On Compensation Bir Philippines Business Tips Philippines

How To Compute Philippine Bir Taxes

Revised Withholding Tax Table Bureau Of Internal Revenue

Corporation Or Sole Proprietorship A Tax Perspective Businessworld

Tax Calculator Compute Your New Income Tax

How To Compute Income Tax In The Philippines An Ultimate Guide

Train Law Tax Table 2021 A Guide To Computing Income Tax

Taxable Income Formula Calculator Examples With Excel Template

Tax Calculator Philippines 2021

Tax Calculator Compute Your New Income Tax

Employees Vs Professionals Which One Pays More Taxes

Tax Calculator Compute Your New Income Tax

What Are The Income Tax Rates In The Philippines For Individuals Business Tips Philippines

How To Compute Income Tax In The Philippines An Ultimate Guide

Post a Comment for "How To Calculate Annual Taxable Income Philippines"