How To Calculate Annual Household Income After Taxes

It can also be used to help fill steps 3. Your annual income includes everything from your yearly salary to bonuses commissions overtime and tips earned.

German Income Tax Calculator Expat Tax

For example say that you have 20000 in eligible income your husband has 40000 and your household has 5000 in eligible deductions.

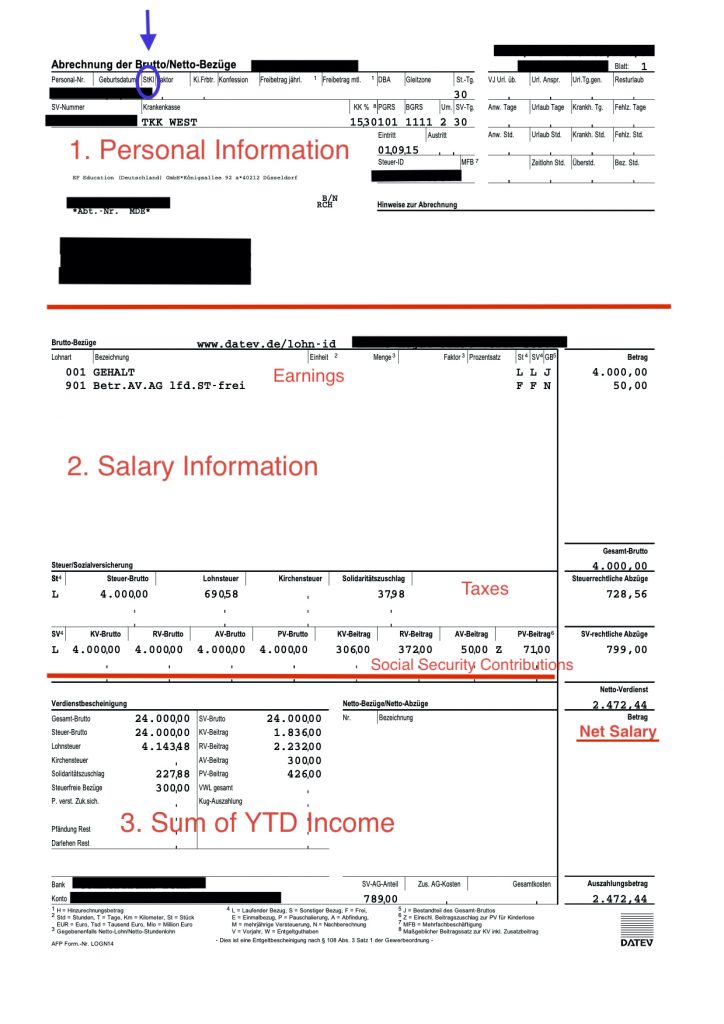

How to calculate annual household income after taxes. Add the following kinds of income if you have any to your AGI. Enter either your gross hourly wage into the first field or your gross annual income into the fourth field. Now lets see more details about how weve gotten this monthly take-home sum of 2570 after extracting your tax and NI from your yearly.

An income tax calculator is a tool that will help calculate taxes one is liable to pay under the old and new tax regimes. H is the number of hours worked per day. D is the number of days worked per week.

40000 After Tax Explained. See another way to estimate your income. Gross annual income is your earnings before tax while net annual income is the amount youre left with after.

How to make an estimate of your expected income. After-Tax Income Gross Income Taxes. Gross annual income and net annual income.

The calculator uses necessary basic information like annual salary rent paid tuition fees interest on childs education loan and any other savings to calculate the tax. Set the net hourly rate in the net salary section. Select your household income in the top left to start.

How much you paid in payroll. Annual Salary PDHWBO. W is the number of weeks worked per year.

To figure your annual household income sum the modified adjusted gross income for all eligible household members. Now we can calculate their after-tax income. Generally household income includes the gross income of each person over 15 years old living in the home and gross income refers to all the income earned prior to any withholding for taxes or other deductions.

To find your. Total Taxes 1413 543 865 2821. Multiply your monthly salary by how many hours you work in a year.

Taxpayers can lower their tax burden and the amount of taxes they owe by claiming deductions and credits. Use the calculator below to estimate how much you will owe in taxes. You may hear it referred to in two different ways.

This is a break-down of how your after tax take-home pay is calculated on your 40000 yearly income. Annual income is the total value of income earned during a fiscal year Fiscal Year FY A fiscal year FY is a 12-month or 52-week period of time used by governments and businesses for accounting purposes to formulate annual. As a result you cant just look at your paychecks and add them up because youd be missing out on the amount of money that your employer withholds for income taxes.

To calculate the individuals after-tax income we must first calculate their total taxes by summing up their tax rates. Are calculated based on tax rates that range from 10 to 37. Every April 15 or July 15 2020 due to the pandemic Americans must file their Federal Income taxes.

Individuals can also account for state and local taxes when calculating. If you earn 40000 in a year you will take home 30840 leaving you with a net income of 2570 every month. Annual net income calculator.

Whether youll see a handy direct deposit in your bank account or have to pay the Internal Revenue Service IRS depends on many factors. In addition to this most people pay taxes throughout the year in the form of payroll taxes that are withheld from their paychecks. Net income is the money after taxation.

There are two ways to determine your yearly net income. 75000 x 02821 2115750. However more correctly its the adjusted gross income from the tax return plus any excludible foreign earned income and tax-exempt interest received during the taxable year.

Start with your households adjusted gross income AGI from your most recent federal income tax return. Take-Home-Paycheck Calculator Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary. Where P is your hourly pay rate.

This marginal tax rate means that your immediate additional income will be taxed at this rate. How to calculate annual income. For instance an increase of 100 in your salary will be taxed 3613 hence your net pay will only increase by 6387.

Where BO is bonuses or overtime. Most times modified adjusted gross income is the same as total income. Some money from your salary goes to a pension savings account insurance and other taxes.

Annual income is defined as the annual salary before taxes an individual earns on a yearly basis. An eligible household member is anyone who needs to file a tax return. Youll find your AGI on line 7 of IRS Form 1040.

Gross annual income refers to all earnings Earnings Before Tax EBT Earnings before tax or pre-tax income is the last subtotal found in the income statement before the net income. The after-tax income is 27000 or the difference between gross earnings and income tax 30000 - 3000 27000. The household income figure is used to determine if you have to pay a penalty on the Affordable Care Act.

Dont have recent AGI. Therefore the individuals total annual taxes are 2115750. Your average tax rate is 222 and your marginal tax rate is 361.

Annual income is the amount of income you earn in one fiscal year. Income taxes in the US. If you work 2000 hours a year and make 25 per hour then you would add 4 zeros from the annual salary multiply the result by 2 to get 50000 per year.

The following calculator can be used to calculate your hourly to salary rate.

Tax Class In Germany Explained Easy 2021 Expat Guide

Illinois Income Tax Calculator Smartasset Federal Income Tax Capital Gains Tax Income Tax

German Wage Tax Calculator Expat Tax

Tax Class In Germany Explained Easy 2021 Expat Guide

Why A Middle Class Lifestyle Can Now Cost You Over 300 000 A Year Middle Class Lifestyle Middle Class Lifestyle

Disposable Income Formula Examples With Excel Template

Tax Class In Germany Explained Easy 2021 Expat Guide

Your Bullsh T Free Guide To Taxes In Germany

Your Bullsh T Free Guide To Taxes In Germany

Disposable Income Formula Income Disposable Spending Habits

Income Taxation In Germany Gofrankfurttax

Tax Class In Germany Explained Easy 2021 Expat Guide

Net Household Savings Rate In Selected Countries 2019 Saving Rates Savings Household

Total Comprehensive Income Astra Agro Lestari Tbk 2017 2018 Financial Statements Accounting Income Financial Statement Basic Concepts

Chart Of The Week Household Income Soars In Energy Producing States Energy Development Charts And Graphs Household Income

Your Bullsh T Free Guide To Taxes In Germany

German Income Tax Calculator Expat Tax

Income Tax Calculator Calculate Income Tax Online Fy 2020 21

:max_bytes(150000):strip_icc()/AppleIncomeSattementDec2019-cd967d0a8f5e4748a1060f83a7e7acbc.jpg)

Post a Comment for "How To Calculate Annual Household Income After Taxes"