How To Calculate Annual Gross Income

The resulting number can be multiplied by 52 for the weeks in the year. Salary Calculator Instructions.

Net Salary Calculator Templates 13 Free Docs Xlsx Pdf Salary Calculator Calculator Design Salary

How Much Annual Income Do You Need to Be Approved for a Credit Card.

How to calculate annual gross income. The adjusted annual salary can be calculated as. Gross Pay or Salary. Step 3 hourly wage.

Take that product and multiply it by twelve the number of months in a year to calculate your gross income for the year. Find your total gross earnings before deductions on your pay stub. The following calculator can be used to calculate your hourly to salary rate.

Annual Salary PDHWBO Where P is your hourly pay rate D is the number of days worked per week. They can do so by multiplying their hourly wage rate by the number of hours worked in a week. If this is the case her net taxable income would be as follows.

One example is a 1200 weekly pay being multiplied by 52 to get an annual gross income of 62400. Just remember to use your gross hourly wage. If youre paid hourly multiply your wage by the number of hours you work each week and the number of weeks you work each year.

For example if you earn 12 per hour and work 35 hours per week for 50 weeks each year your gross annual income would be 21000 12 x 35 x 50. To enter your time card times for a payroll related calculation use this time card calculator. 57 rows How to Calculate Annual Salary.

How often a person gets paid and the amount determines annual gross income. Step 4 calculate results. Here are the steps to calculate annual income based on an.

Or Enter either your gross hourly wage into the first field or your gross annual income into the fourth field. Calculate gross pay before taxes based on hours worked and rate of pay per hour including overtime. Dec 01 2020 To calculate gross annual income enter the gross hourly wage in the first field of this yearly salary calculatorThe result in the fourth field will be your gross annual incomeIf youre wondering how to calculate gross annual income by yourself - use the formula mentioned earlier.

Gross pay is the total amount of money you get before taxes or other deductions are subtracted from your salary. According to Measom a distinction must be made between being paid twice a month and every two weeks and confusing the two results in a wrong calculation. 53000 5000 48000 Net taxable income.

How do I calculate my gross annual income. Then multiply that figure by four the number of weeks in a month to calculate your monthly earnings. Now that you know your annual gross income divide it by 12 to find the monthly amount.

Multiply this amount by the number of paychecks you receive each year to calculate your. All bi-weekly semi-monthly monthly and quarterly figures. Calculate your annual salary.

This number will be an average. First to find your yearly pay multiply your hourly wage by the number of hours you work each week and then multiply the total by 52. For example if over the past four.

30 8 260 - 25 56400 Using 10 holidays and 15 paid vacation days a year subtract these non-working days from the total number of working days a year. Enter the number of hours per week you typically work. Step 2 time off.

Step 1 hours per week. Gross income per month Annual salary 12 To determine gross monthly income from hourly wages individuals need to know their yearly pay. 32000 21000 53000 Total gross annual income If Sarah is eligible for deductions of 5000 for education andor childcare expenses she may be able to lower her taxable income in some jurisdictions.

Set the net hourly rate in the net salary section. There are two ways to determine your yearly net income. If you are paid an hourly wage on the other hand you may need to figure out your gross income using last years tax return or by multiplying your gross weekly income by the number of weeks.

Back Of The Envelope Retirement Calculator Retirement Calculator Saving For Retirement Savings Calculator

Calculation Of Income From House Property How To Save Tax On Rental Income In India Rental Income Tax Deductions Income

Gross Vs Net Income Importance Differences And More Bookkeeping Business Finance Investing Accounting Classes

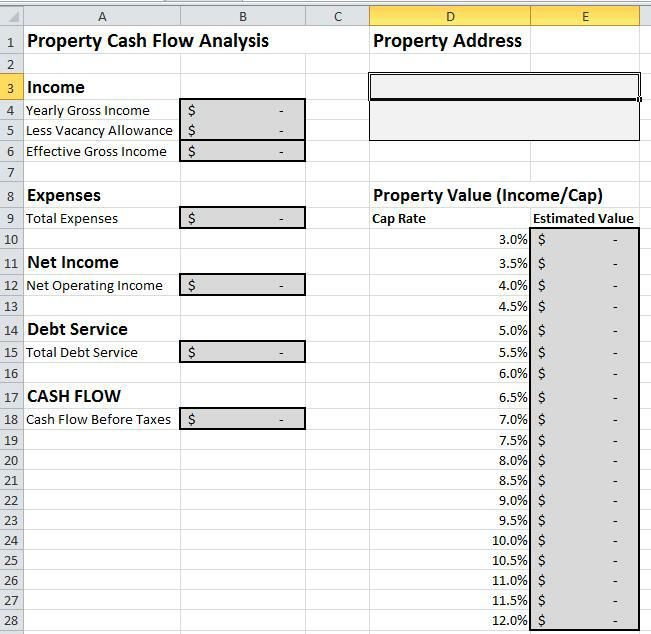

Rental Property Roi And Cap Rate Calculator And Comparison Etsy In 2021 Rental Property Rental Property Management Real Estate Investing

Installment Sales Method Gross Profit Percentage Deferred Gross Profit Method Profit Accounting

Easy To Use Closing Cost And Mortgage Calculator For Pa Home Buyers And Real Estate Agents Nice Print Featu Mortgage Calculator Mortgage Amortization Mortgage

Taxable Income Calculator India Income Business Finance Investing

Investing Rental Property Calculator Roi Mls Mortgage Investing Cash Flow Statement Mortgage Refinance Calculator

Calculate Your Earnings With A Traditional Ira Traditional Ira Loan Calculator Calculator

How To Calculate Depreciation On Fixed Assets Fixed Asset Economics Lessons Calculator

How To Calculate Net Income 12 Steps With Pictures Annual Income Net Income Income Calculator

Rental Cash Flow Analysis Spreadsheet For Excel Cash Flow Spreadsheet Investment Analysis

How To Calculate Salary Increase Percentage In Excel Free Template Salary Increase Salary Excel

Paycheck Calculator For Excel Paycheck Salary Calculator Payroll Taxes

Consumer Math Notes Print And Digital Consumer Math Financial Literacy Lessons Financial Literacy Worksheets

Investing Rental Property Calculator Determines Cash Flow Statement De Real Estate Investing Rental Property Real Estate Rentals Rental Property Investment

Total Comprehensive Income Astra Agro Lestari Tbk 2017 2018 Financial Statements Accounting Income Financial Statement Basic Concepts

Gross Vs Net Income Importance Differences And More Bookkeeping Business Finance Investing Accounting Classes

Post a Comment for "How To Calculate Annual Gross Income"