Calculate Total Gross Income Yearly

Regular Military Compensation RMC is defined as the sum of basic pay average basic allowance for housing basic allowance for subsistence and the federal income tax advantage that accrues because the allowances are not subject to federal income tax. Overtime Rate 1688 hour.

Taxable Income Formula Examples How To Calculate Taxable Income

Multiply your hourly wage by the number of work hours per day.

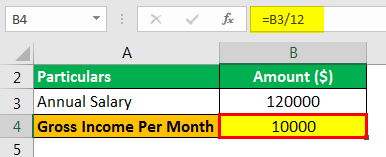

Calculate total gross income yearly. One example is a 1200 weekly pay being multiplied by 52 to get an annual gross income of 62400. If you want to do it without the yearly salary income calculator substitute your numbers into this formula. Since the above is the monthly income multiply it by 12 to calculate the yearly taxable income.

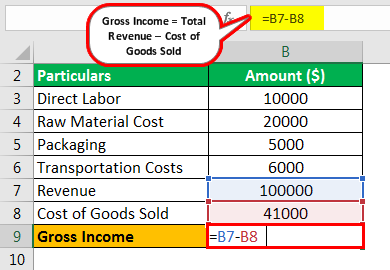

What is a 173501k after tax. Gross income Gross revenue - Cost of goods sold. How Much Annual Income Do You Need to Be Approved for a Credit Card.

RMC represents a basic level of compensation. Annual income hourly wage hours per week weeks per year. Double Time Rate 2250 hour.

For example incomes like rental income interest income and losses in trading or transacting. Gross income 13625000. See how we can help improve your knowledge of Math Physics Tax.

Sep 01 2019 What is Gross Annual IncomeAnnual income is the total value of income earned during a fiscal year Fiscal Year FY A fiscal year FY is a 12-month or 52-week period of time used by governments and businesses for accounting purposes to formulate annualGross annual income refers to all earnings. Using 10 holidays and 15 paid vacation days a year subtract these non-working days from the total number of working days a year. How often a person gets paid and the amount determines annual gross income.

Gross Annual Income of hours worked per week x of weeks worked per year x hourly wage. If youre paid hourly multiply your wage by the number of hours you work each week and the number of weeks you work each year. The next step is to add all other incomes and deduct losses.

30 8 260 - 25 56400. Regular Rate 1125 hour. Here are the steps to calculate annual income based on an hourly wage using a 17 hourly wage working 8 hours per day 5 days a week every week as an example.

For example if you earned 40000 last year and 50000 this year -- no matter when you received those payments over the course of the years -- the lender adds the income for both years 40000 50000 90000 and divides by 24 months to determine your average monthly gross income which is 3750 in this example 90000 24 months 3750 in average monthly income. In digits that would be 35 x 40 hours per week which is equals to 1400. Total Gross Pay for.

After multiplying this amount by 52 you. The company finds that their gross income of 13625000 beats their previous record of 12000000. 1735011 Federal and State Tax Calculation by the US Salary Calculator which can be used to calculate your 2021 tax return and tax refund calculations.

For example if you earn 12 per hour and work 35 hours per week for 50 weeks each year your gross annual income would be 21000 12 x 35 x 50. The following calculator can be used to calculate your hourly to salary rate. All bi-weekly semi-monthly monthly and quarterly figures are derived from these annual calculations.

Gross income 15000000 - 1375000. To determine your gross monthly income take your hourly rate and multiply it by 40 number of hours in a week and 52 number of weeks in a year. 53000 5000 48000 Net taxable income.

How to Calculate Annual Salary. 109961692 net salary is 173501100 gross salary. Annual Salary PDHWBO Where P is your hourly pay rate D is the number of days worked per week.

One of a suite of free online calculators provided by the team at iCalculator. The adjusted annual salary can be calculated as. In our example your daily salary would be 136 17 per hour times 8 hours per day.

If youre still confused about how to find annual income have a look at the examples. 32000 21000 53000 Total gross annual income If Sarah is eligible for deductions of 5000 for education andor childcare expenses she may be able to lower her taxable income in some jurisdictions. Annual Income - Learn How to Calculate Total Annual Income.

If this is the case her net taxable income would be as follows. Regular Military Compensation RMC Calculator. The formula for the annual income is.

According to Measom a distinction must be made between being paid twice a month and every two weeks and confusing the two results in a wrong calculation.

Taxable Income Formula Calculator Examples With Excel Template

4 Ways To Calculate Annual Salary Wikihow

How To Calculate Gross Income Per Month The Motley Fool

Gross Income Formula Step By Step Calculations

Gross Income Formula Step By Step Calculations

What Is Revenue Run Rate Formula How To Calculate

What Is Gross Income Business Gross Income Individual Gross Income Mageplaza

Calculating 1 3 Of Your Income

Sales Revenue Formula Calculate Grow Total Revenue

Gross Income Formula Step By Step Calculations

How To Calculate Net Income 12 Steps With Pictures Wikihow

Salary Formula Calculate Salary Calculator Excel Template

Salary Formula Calculate Salary Calculator Excel Template

What Is Gross Income Business Gross Income Individual Gross Income Mageplaza

Salary Formula Calculate Salary Calculator Excel Template

Post a Comment for "Calculate Total Gross Income Yearly"