How To Calculate Yearly Salary With Overtime

Next take the total hours worked in a year and multiply that by the average pay per hour. If an employee whose monthly salary is THB 24000 works for an hour after 5 PM then the overtime rate is 150 of his hourly rate.

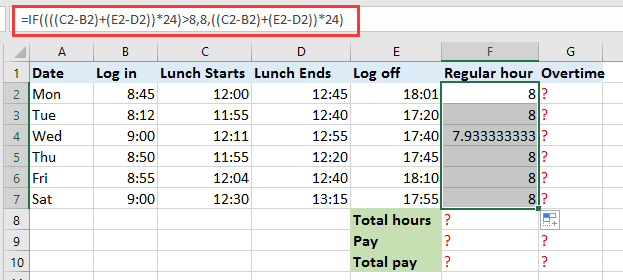

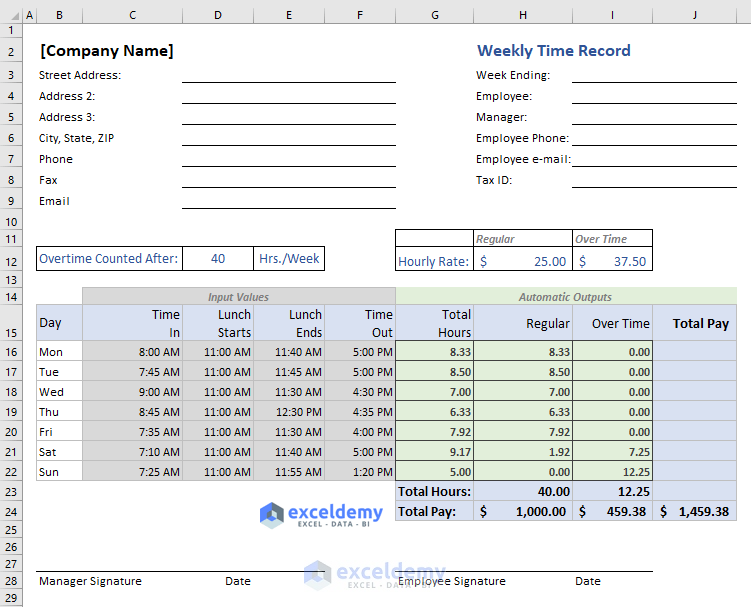

How To Quickly Calculate The Overtime And Payment In Excel

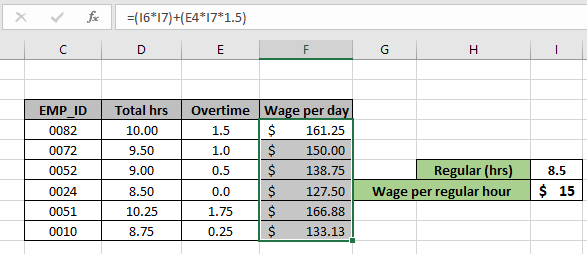

As an example an employee who works 5 extra hours a day and has an hourly rate of 15 will see the following calculation for their OT Regular pay of 15 8 hours 120 Overtime pay of 15 5 hours 15 OT rate 11250 Wage for the day 120 11250 23250.

How to calculate yearly salary with overtime. Calculate total compensation for week. The algorithm behind this overtime calculator. Since straight-time earnings have already been calculated see Step 1 the additional amount to be calculated is one-half the regular rate of pay 10 x 5 5.

Using an overtime hours calculator also known as an overtime wage calculator is much easier than calculating the amount you should pay employees who currently make an annual salary and need to be converted to an hourly rate. Divide your annual salary in half and drop the thousand. 10 regular rate of pay x 5 x 10 overtime hours 50.

If you find use out of our wage conversion calculator why not add a widget version of it to your website. First calculate the number of hours per year Sara works. Note the total pay is what you actually earn per hour.

40 x 1389 55560 total regular wages. If you make 60000 a year your hourly salary is approximately 30 an hour. Gross pay gross hourly rate x number of hours worked for a pay period In this case lets calculate Marias gross pay per year.

Plus if you get paid on a salary basis but you are working more than 40 hours per week the calculator will even. The total hours that Maria is supposed to work for the period of one year is. The Annual Salary Calculator will translate your hourly pay into its yearly monthly biweekly weekly and daily equivalents including any weekly time-and-a-half overtime wages.

Salary 52 overtime hours 15 40 hourly rate Lets say your employee earns a salary of 31200 per year and works an average of 45 hours per week. 37 x 50 1850 hours. Using a 30 hourly rate an average of eight hours worked each day and 260 working days a year 52 weeks multiplied by 5 working days a week the annual unadjusted salary can be calculated as.

If you expect the employee to work 40 hours a week you can skip this step since the regular wages will be the same as the weekly salary. Salary to Hourly Pay Calculator with Lost-Overtime-Wage Feature. As of December 1 2016 the ceiling for mandatory overtime payment will be a salary of 913 per week or 47476 per year for white collar workers.

You need to use 30 days per month even if a particular month has more or fewer than 30 days and 8 hours per day to calculate his hourly rate. Gross vs Net Income. 500 straight-time pay 50 overtime pay 550.

Overtime hours worked and pay period both optional. Enter your normal houlry rate how many hours hou work each pay period your overtime multiplier overtime hours worked and tax rate to figure out what your overtime hourly rate is and what your paycheck will be after income taxes are deducted. This online Salary to Hourly Pay Calculator will translate your weekly monthly or annual salary into its per minute hourly daily weekly and monthly equivalents.

30 8 260 62400. 1850 x 22 40700. In our example his hourly rate is 24000308 THB 100.

- Triple time and a half which means your standard rate is multiplied by 35. Calculating an Annual Salary from an Hourly Wage. 75000 a year is about 3750 an hour.

Overtime 2 - Provides the Overtime 2 pay rate hours worked and earnings. If you work 40 hours per week you can also quickly figure out your approximate hourly wage from your annual salary. Plus since you can adjust the weekly hours and number of work weeks per year the calculator.

The pay is averaged over the number of hours worked. Overtime Calculator Usage Instructions. This means that many but not all employees with a yearly salary at or below 47476 are entitled to mandatory overtime pay for any hours worked over 40 in.

Our free online Annual Salary Calculator allows you to convert your hourly wage into its yearly quarterly monthly weekly and daily equivalents. Total number of hours per year 40 hours per week x 52 weeks 2080 hours. Here is the basic equation for this method.

Total - Provides the average pay rate total hours worked and the total pay. To start find the employees weekly salary. This is equal to 37 hours times 50 weeks per year there are 52 weeks in a year but she takes 2 weeks off.

Since overtime pay starts after 40 hours worked a week according to FLSA rules calculate the employees regular wages using the regular hourly rate. - Or can be a quadruple time which is normal pay rate multiplied by 4 or even a customizable value by case Other.

Salary To Hourly Pay Calculator With Lost Overtime Wages Feature

Your Step By Step Correct Guide To Calculating Overtime Pay

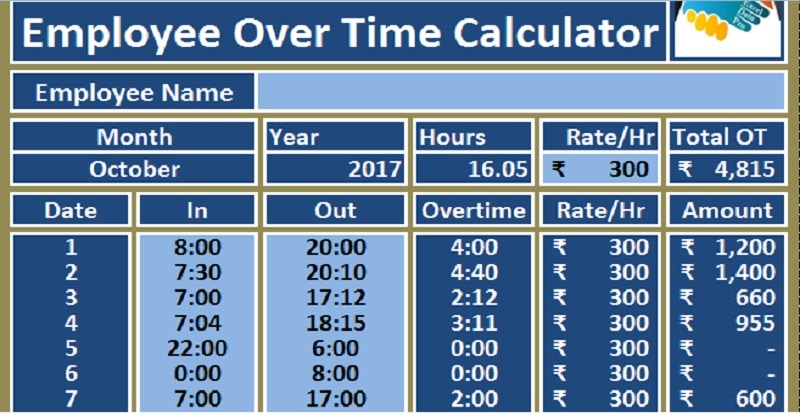

What Are Overtime Costs Definition Formula Applicability Exceldatapro

Employees Daily And Monthly Salary Calculation With Overtime In Excel By Learning Centers Excel Tutorials Salary

How To Calculate Overtime Pay Easy Overtime Calculator A Basic Guide

Download Employee Overtime Calculator Excel Template Exceldatapro

3 Ways To Calculate Your Hourly Rate Wikihow

How To Calculate Overtime Pay For Emplyees In 2021 Quickbooks

Excel Formula Basic Overtime Calculation Formula

Calculate Overtime Amount Using Excel Formula

Mathematics For Work And Everyday Life

How To Quickly Calculate The Overtime And Payment In Excel

Excel Formula Timesheet Overtime Calculation Formula Exceljet

Excel Formula To Calculate Hours Worked Overtime With Template

4 Ways To Calculate Annual Salary Wikihow

How To Quickly Calculate The Overtime And Payment In Excel

Post a Comment for "How To Calculate Yearly Salary With Overtime"