How To Calculate Annual Tax

It can be used for the 201314 to 202021 income years. There are many other possible variables for a definitive source check your tax code and speak to the tax office.

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Estimate your Income Tax for the current year.

How to calculate annual tax. Your household income location filing status and number of personal exemptions. Created with Highcharts 607. Our income tax calculator calculates your federal state and local taxes based on several key inputs.

This calculator assumes youre employed as self-employed national insurance rates are different. Highlights of the FIRB Accomplishment Report CY 2014. An income tax calculator is a simple online tool which can help you calculate taxes payable on your income.

Procedures for Availment of Tax Subsidy of GOCCs. It will not include any tax credits you may be entitled to for example the independent earner tax credit IETC. The online tax calculator requires some data concerning income investments and expenses of the taxpayer to calculate taxes online.

Magnitude of Tax Subsidy Grant and Utilization By Recipient 2006-2015. This calculator will calculate the tax payable on any given annual. Enter either your gross hourly wage into the first field or your gross annual income into the fourth field.

Use the simple annual Canada tax calculator or switch to the advanced Canada annual tax calculator to review NIS payments and income tax deductions for 2021. If you wish to know more about FY 20-21 income tax slabs click now. Please enter your salary into the Annual Salary field.

Total Estimated Tax Burden 19560. Here is what you can calculate with the Annual Tax Calculator. Use this service to estimate how much Income Tax and National Insurance you should pay for the current tax year 6 April 2021 to 5 April 2022.

How to use our Tax Calculator. This is only a ready reckoner that makes standard assumptions to estimate your tax breakdown. This simplified ATO Tax Calculator will calculate your annual monthly fortnightly and weekly salary after PAYG tax deductions.

It also will not include any tax youve already paid through your salary or. Percent of income to taxes 35. But calculating your weekly take-home pay isnt a simple matter of multiplying your hourly wage by the number of hours youll work each week or dividing your annual salary.

The Annual Tax Calculator is our most comprehensive payroll associated tax and deductions calculator from our suite of UK tax calculators. Remember to adjust the first two fields of the calculator as necessary. Set the net hourly rate in the net salary section.

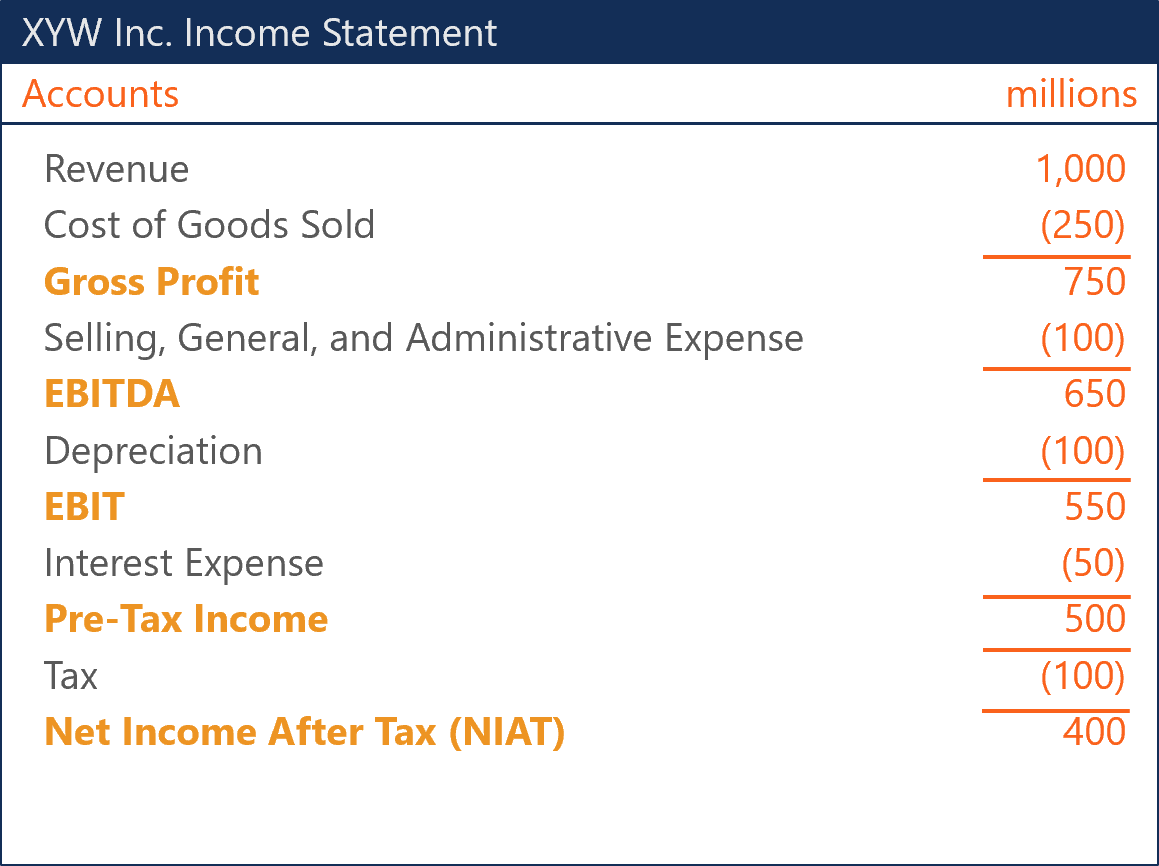

Earnings Before Tax EBT Earnings before tax or pre-tax income is the last subtotal found in the income statement before the net income line item. What this calculator doesnt cover. Then enter the tax rate for both.

When you start a new job or get a raise youll agree to either an hourly wage or an annual salary. To calculate your salary simply enter your gross income in the box below the GROSS INCOME heading select your income period default is set to yearly and press the Calculate button. Before you use the calculator.

Tax Incentives Management and Transparency Act TIMTA Process Task Force on Fees and Charges. How Your Paycheck Works. This calculator helps you to calculate the tax you owe on your taxable income for the full income year.

Gross annual income refers to all earnings. Use this calculator to work out your basic yearly tax for any year from 2011 to 2021. Your Annual tax calculation split into amounts per year month week and daily rates.

Information you need for this calculator. You can calculate your Annual take home pay based of your Annual gross income and the tax allowances tax credits and tax brackets as defined in the 2021 Tax Tables. Fuel Tax 150.

Let us now see the step-by-step process of how one can make use of the Scripboxs Income Tax calculator online. Fiscal Year FY A fiscal year FY is a 12-month or 52-week period of time used by governments and businesses for accounting purposes to formulate annual. We have updated our income tax calculator according to the latest income tax rates rules so you may calculate your tax with accuracy and without worry.

Sometimes official ATO tax calculator is too complicated when you want just quickly run various scenarios and find out your salary after tax whether its your current payslip pay increase or a new job offer. Which tax rates apply.

How To Calculate Income Tax In Excel

Excel Formula Income Tax Bracket Calculation Exceljet

Excel Formula Tax Rate Calculation With Fixed Base Exceljet

New Tax Regime Tax Slabs Income Tax Income Tax

Income Tax Calculator Income Tax Life Insurance Companies Income Tax Return

How To Calculate Income Tax In Excel

Taxable Income Formula Examples How To Calculate Taxable Income

How To Calculate Income Tax In Excel

What Is Annual Income How To Calculate Your Salary Salary Calculator Income Income Tax Return

Calculate Income Tax In Excel How To Calculate Income Tax In Excel

How To Calculate Sales Tax In Excel

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

Deferred Tax Asset Definition Calculation

How To Calculate Income Tax In Excel

Calculate Your Income And Know About The Applicable Tax To Be Paid By You Tax Income Tax Income Tax Saarland Income

Tax Calculator Excel Spreadsheet Excel Spreadsheets Excel Spreadsheet

Net Income After Tax Niat Overview How To Calculate Analysis

Calculate Income Tax In Excel How To Calculate Income Tax In Excel

How To Calculate Income Tax In Excel

How To Create Excel Data Entry Form With Userform That Calculates Income Tax Full Tutorial In 2021 Microsoft Excel Tutorial Excel Tutorials Income Tax

Post a Comment for "How To Calculate Annual Tax"